2023 CEO Letter: “Everybody has a plan until they get punched in the mouth.” – ‘Iron’ Mike Tyson

- March 6, 2023

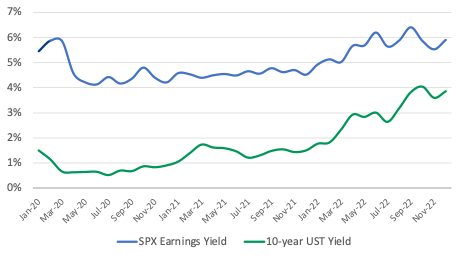

As crude as this quote is, it’s true. 2022 was a reckoning for many investors across asset classes. The combination of a hawkish recessionary outlook from major financial institutions, rate hikes from the Federal Reserve, and a material sell-off in the public markets, particularly in the growth and technology sectors led investors to dampen their risk appetite significantly. I won’t bore you with too many charts and graphs, but I have been intrigued by the dramatic change in the market risk premium as implied by the earnings yield of the S&P 500 charted against the 10 Year Treasury.

As you can see since January 2020 the market risk premium has decreased from ~4% to ~2% at YE2022. In early 2020 the S&P earnings yield was ~5.4%. Today it’s 5.9%. But over the same period the 10YR treasury yield has slid from 1.5% to 3.9%. For the record, the same market risk premium ended the year at 5.8% in 2012. Said another way, over the last 10 years you are consistently getting paid less than ever to take more risk.

I surmise that investors, in particular larger allocators, have been left to make difficult choices as a result of the above — none of which they find all that appetizing. Investors either 1) believe that equities are overpriced and therefore move from riskier assets into bonds or cash (and potentially miss out on yield), 2) grow exposure in equities, either recognizing that you are getting paid less on a relative basis to take risk or believing in above-market economic growth despite what the Federal Reserve would have you believe, or 3) do nothing. Paying attention to the stock market in 2022 it was clear how this dynamic affected the appetite of public market investors. Unless you were in a seat like ours, it was likely less clear how it affected private capital flows.

“We do this not because it is easy, but because we thought it would be easy!” – (Not) John F. Kennedy

In 2022 the private equity market and in particular emerging managers like us had to contend with LPs who for the first time in many years had a ‘denominator’ issue—i.e. because of losses most acutely in their public markets portfolios they found themselves dramatically over-allocated to private equity. Translation: fundraising in 2022 was slower than Trident expected it would be. In spite of these headwinds we managed to deploy just under $40M and have a busy pipeline that we expect to deploy into throughout 2023. As we speak Trident is sourcing over $1B of dealflow per quarter, majority of which is completely proprietary. We are very long on great ideas and look forward to continuing to buy great assets at reasonable prices this year.

Notwithstanding the above, I’m happy to report that our performance was better than what we even underwrote, which creates an interesting juxtaposition: in what was our best year performance-wise, we had to work harder than ever before to fund companies that were organically outpacing the market. We believe that in a high rate, slower growth environment it will become all the clearer how important our value-oriented strategy is. Enough rhetoric though, let’s talk a couple examples and numbers from our portfolio:

- Lumina Vision Partners, quadrupled EBITDA in the first 12 months driven by both organic growth and a robust M&A strategy. The Company closed on 5 transactions this year, representing 10 new locations and incremental EBITDA. Simultaneously, Lumina has built robust corporate processes and infrastructure that we believe will enable it to grow to over 75 practices within the next 24 months. Special thanks goes out to our great management team as well as Chris and Tony at RTC for their hard work. We are happy to report that Lumina’s future pipeline for growth continues to look robust.

- Excel Interior Door: Since investment close in January 2022, Excel, a manufacturer of interior doors in the Southeast, has organically grown EBITDA nearly 25%. Over the last year, Trident, along with a great management team in partnership with Chris Ayala from Drum (ISOP), has made major strides in professionalizing the Company’s HR function, putting a new HR Manager in place and shifting the business’ payroll and onboarding processes from paper to Paylocity, and engaging TCGI, a black- and woman-owned technology consultancy, to optimize the Company’s internal technology stack. We believe Excel is well positioned to continue to weather macroeconomic headwinds in the housing market as it capitalizes on local under-build, optimizes its sales efforts, and realizes additional operating leverage with increasing scale.

On the Trident home front, we experienced our first turnover in 5 years – one departure from the Investment team and two from the Strategy & Operations team. While momentarily jarring for our little community that has been riding together from the start, what has emerged is a leaner, more efficient team of professionals committed to delivering for our investors and communities we operate in. We wish them the best moving forward and are excited that the Trident Alumni Network is off to a strong start!

From a growth perspective, Trident is excited to welcome Kevin Obara, Director on the Investment team, who joined us in September from Handshake after spending time at Carlyle, Citadel, and Harvard Business School. Kevin brings a bevy of both operational and financial expertise that has already been put to good use.

Trident is also happy to announce promotions this year: Ben Rosenbaum to Vice President on the Investment Team and Ragini Chawla to Senior Associate.

What’s Really Important

At the risk of sounding trite given the start of my 2022 annual letter, I must repeat that I’m not the most consistent watcher of television shows, and when I am, I tilt towards the Sci-Fi or Fantasy genres, picking shows like Game of Thrones to spend my time on.1 But this past year I fell in love with America’s favorite: Yellowstone. I’ve been a Kevin Costner fan since Oscar-winning Dances with Wolves, but he’s outdone himself playing a Montana rancher who promises his father he will maintain the family legacy and not forfeit any of the ranch he’d inherited. In Season 1 he had an interesting quote that many watchers applied to his children, but I believe he was doubly talking about his family’s land and legacy.

“Tomorrow is the only thing a parent’s supposed to live for” – John Dutton

At Trident we’ve thought very carefully about how to lure in great talent and incentivize them to perform at a high level, through cycle. But great businesses aren’t just built on proper incentives, they are built on vision. We work our asses off at this firm because we all believe in the Trident of tomorrow that we are building.

We’ve had a strong sense of destiny here at this firm since our inception. There’s been a ‘knowing’ that comes with working here that is difficult to explain but clearly visible when examining the tenure, focus, unceasing pursuit of excellence, and consistency of our team. Our people are special—so I wanted to take a moment in this letter to express my heartfelt public gratitude to each and every one of these OGs.2

Alexis: You’ve helped me handcraft almost every deal in our portfolio. Thank you for seeing what I so often don’t and being the partner and friend I didn’t even know I needed.

Ragini: You invented Corporate Zone Defense. Nothing gets past you in spite of the fact that you’ve pushed yourself to learn new skillsets and apply them for Trident’s benefit.

Kevin: Tenacity and hustle personified. Thank you for making the rapid adjustments to assimilate into how we do business as a more recent addition.

Aron: You are always doing the right thing at the right time, and most of it might go unseen. But from those of us who do see it, thank you.

Nick: It doesn’t get more OG than you my brother. Thank you for asking the toughest questions at the most inconvenient times. We’d have stepped on plenty of landmines otherwise.

Ben: It’s been my absolute privilege to watch you develop from an intern into something a hell of a lot more dangerous. The wind is at your back, keep it up!

Andrew: We have been riding together for years. Thank you for your commitment!

Shana: Lord knows I wouldn’t survive a day without your attention to detail and acute spidey-senses. Thank you!

All these niceties being said, we’ve had our fair share of miscommunications, false starts, and chemistry mismatches. Team building is difficult work; I don’t want anyone reading this to mistake our compliments and optimism for things being always smooth and steady. If a business ever could face seasonal depression, we’ve certainly had our fair share given everything the market has thrown at us over the last 5-6 years. The pandemic and ensuing retracing brought out just about every adjective I’d seen in the corporate lexicon: grumpy, chippy, grouchy, and of course, testy. We struggled at times to stay focused on Trident’s long game, our portfolio companies struggled too, and yet here we are: 2022 was a banner year for organic portfolio growth, and we are eyeing our next opportunity to return capital to investors in our legacy portfolio as 2023 kicks into full gear.

At the end of the day, no one on the Trident team doubts why we are here. No one doubts what we are building or our ability to do it. And finally, none of us doubt just what we are building. It’s this shared commitment to legacy that allows my partners and I to remain bullish about our opportunity to perform. If there’s anything my partners and I lose sleep over it’s this notion of tomorrow. We maintain a healthy paranoia that drives us to burn it at both ends to live up to our charge.

I’m excited to share more as the year progresses about how we are investing in our culture and people.

Change to be Proud of

“Leverage is knowing that if someone had all the money in the world, this is what they’d buy.” – John Dutton

Contemporary philanthropy and ‘impact’ have been historically driven by purely profit-motivated organizations and individuals who, once they’ve fed enough, decide to give back. Today it’s beginning to take on a new form in sustainable impact. But traditional logic has been to wait until you are one of the “have too much’s” to give to the “have nots”. Recognizing that we at Trident have something that everyone wants is important. That is, we have an organization that has two powerful layers engrained in its founding DNA: Technology and Social Impact. Doing this from the very start matters.

On Social Impact: At Trident we consistently broadcast our intent to create alpha and return capital for our LPs as a priority while considering other stakeholders in our quest to turn small businesses into medium-sized ones. Doing this while not being pigeon-holed into an “Impact” fund designation has been tricky to say the least—so I’ll say it plainly: Trident is not nor will ever be an “Impact” business, but rather a business that happens to make an impact. Why? Because we are the kinds of folks who naturally root for the underdogs in competitive situations, perhaps just because we identify with them more so than the average bear. Beyond this though, we think there is meaningful amounts of alpha that can be found by looking in places where others don’t to find value. Excel Interior Door is a perfect example of this working. We were able to increase EBITDA organically by just under 25% in the first year, doing so in partnership with an Atlanta-based black-owned business that may have been otherwise overlooked. As we continue to return capital to our partners who have put their trust in us, I look forward to telling more of these stories in my annual letters.

Our Technology: We have an algorithmic process that allows us to spend more time investing in people and businesses we know are most aligned with our commercial objectives. I know that Nick has talked and published about our proprietary SPEAR algorithm at length, but it’s this process that has allowed Trident to take what is today roughly ~$1B in deal flow per quarter and distill that down into 3-4 executable deals per year. I’m happy to announce that we today have over 850 ISOPs in our system—we spend roughly 15 hours per week mining through that network for proprietary transactions in the most closely-held businesses in the market. Look out for more stories about this powerful tool as Trident’s assets under management grow in tandem with the size of our portfolio.

In sum, our decision to create alpha for Limited Partners, build proprietary technology, and push social impact was very deliberate—we believe it’s not just a differentiator but rather a model just about everyone in the alternatives industry will embrace if they haven’t done so already. My advice to those reading: don’t wait until you have all the money in the world. Do it now!

Best,

Eric Taylor

Trident Founder, Chief Executive Officer, and Chief Investment Officer

1 Incidentally, one of the three reasons the company is called Trident stems from Game of Thrones, because Robert Baratheon slew Rhaegar Targaryen at the Battle of The Trident, which of course determined the outcome of Roberts Rebellion and sparked the GoT story as we know it today.

2 Old Guardmembers

INVESTOR CONTACT

Trident Investor Relations

[email protected]

MEDIA CONTACT

Trident Media Relatitons

[email protected]

The content of this Newsletter is for general, informational purposes. Nothing in the Newsletter is intended to be, and you should not consider anything on the Newsletter to be investment, accounting, tax, legal or other professional advice. Trident does not make any representation or warranty of any kind, express or implied, as to the accuracy or completeness of the information contained herein. This Newsletter includes information regarding Trident’s past and present portfolio companies. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. Further, references to Trident’s past and present portfolio companies should not be construed as a recommendation of any particular investment or security. The portfolio companies listed should not be assumed to have been profitable. Any past performance information in the Newsletter is not necessarily indicative, or a guarantee, of future results. Certain transactions may not be publicly announced at the time of distribution of this document and are therefore not included.

The Newsletter may contain forward-looking statements (including those relating to current and future market conditions and trends in respect thereof) that are not historical facts and are based on current expectations, estimates, projections, opinions and/or beliefs of Trident. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. Actual events or results or actual performance of the relevant Fund (or any other entity referred to in the Newsletter) may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions. No representation or warranty is made as to future performance or such forward-looking statements.

Under no circumstances should the information presented be considered an offer to sell, or a solicitation to buy, any security. Such offer or solicitation may only be made pursuant to the current offering documents for the relevant Trident Fund which may only be provided to accredited investors and qualified purchasers as defined under the Securities Act of 1933 and the Investment Company Act of 1940. While the information provided herein is believed to be accurate and reliable, Trident, its advisors and employees make no express warranty as to its completeness or accuracy.

Please view www.trident.co for additional information regarding Trident’s strategies and past and present investments.